OVERVIEW

A complete levy management solution

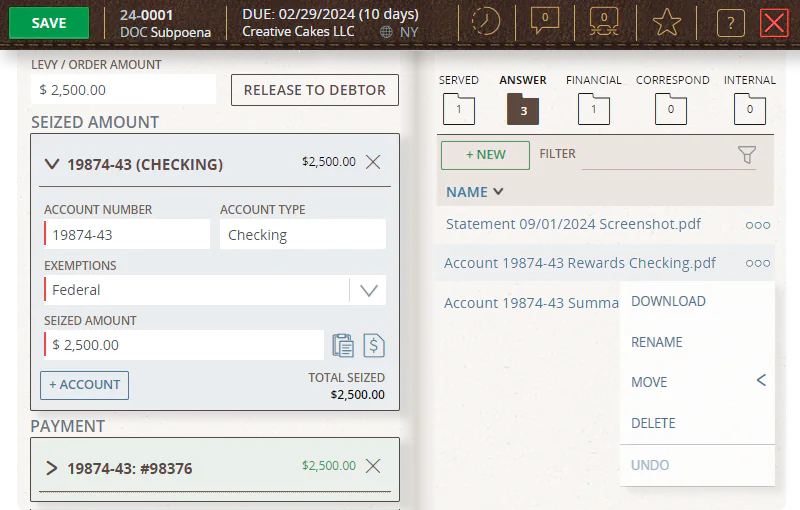

Intake

RECEIPT

New garnishment orders come in via a registered agent feed, internal email to the system, or manual entry.ASSESS

Identify whether the debtor has an account, if funds are exempt, duplicates, and compliance / jurisdictional requirements.Seizure

ACCOUNTS

Track accounts and amounts seized; record exempt funds; and store a screenshot of the debtor’s account.ANALYSIS

Instantly view orders with unseized funds and confirm the cumulative amount frozen for all orders.Tracking

ANSWER

If interrogatory answers are required, track the answer date and store a copy of what was sent.RELEASE

Document a partial or full release from the creditor. Safari automatically updates the funds to be paid.Payment

PREREQUISITES

Ensure payment is made on the required date or confirm that a court order was received before making payment.RECORD

Use prefilled payment records to save time and minimize typing errors.

New Order Intake

Automate Matter Creation

Email scanned copy of manually served order directly into a new Safari matter

Direct Feed from Registered Agent

Receive served orders and populate data with a feed from your registered agent

Centralized Intake

On one screen view all new orders that are unassigned or check which funds are not yet seized

Seizing Funds

Accounts

Capture accounts, amounts seized, and details of any exempt funds

Review

Quickly route to manager or in-house lawyer for review or confirmation

No Funds

If there is no account or if no funds are available, auto-generate notice to garnishor and close matter

Compliance Assurance

Jurisdiction

Setup warnings if the order was not domesticated or served where your entity was not doing business

Account Location

Enforce your compliance policies using key data such as issuing state, account location, and customer address

Customer Notifications

Create templates to auto-generate customer notifications and letters for policy and legal compliance

Workflow Tracking

One System

Easily search and find details and status in one place

Action Reports

View a list of all orders with an upcoming answer or payment due

Releases

Auto-update the seized amount with partial or full releases by the garnishor

File Management

View documents inline

Review served order alongside matter details and upcoming tasks

Screenshots

With one click, upload a screenshot image of debtor’s account detail

Automate correspondence

Auto-populate and send standard communications from templates

Payment

Recordkeeping

Capture key payment information such as account, amount, check number and date

Pre-filled with Validation

Generate pre-filled payment entries that the system validates for accuracy

Fees

Track fees collected from the garnishor or processing fees charged to the debtor

Management Oversight

Run reports

View preconfigured or custom reports and charts

View activity

Audit history captures every action taken in the system

Limit access

Restrict certain matters and actions to specified users

Trust and Security

Compliance

Meets highest industry standards such as HIPAA, GLBA, and 23 NYRR Part 500

Auditing

SOC 2 compliant verified by an independent auditor annually

Encryption

All client data encrypted at rest (AES-256 bit) and in transmission (SSL-TLS 1.2)

“Culturally, we strive for the best technology and people. We want to get away from manual processes because they take time and cost more in the long run. We're relying on Safari to replace outdated processes.”

Brian Hunt

Brian HuntSenior VP and GC,

First Merchants Bank

“Our motto is ‘smarter banking,’ and our legal process team is working smarter with Safari. We’ve eliminated tracking in spreadsheets and automated our subpoena response processes.”

Nick Mitchell

Nick MitchellVP Legal Affairs,

Logix